Infrastructure pivotal in aged care?

Could privatising infrastructure and property assets relieve the burden of an ageing population?

Australians are living longer but how to pay for that privilege represents a major public policy conundrum. The latest AMP Capital Global Equities Forum held a multi-regional debate over whether the ‘young’ or the ‘old’ should foot the bill.

Privatisations could hold key

Governments could consider re-privatising infrastructure and property assets when their long-term leases end to help support Australia's ageing population, according to one member of the debate panel.

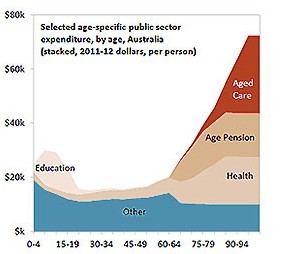

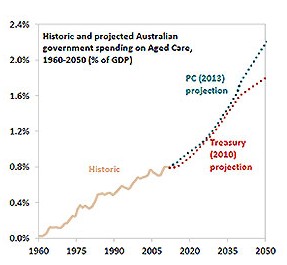

Those arguing for it suggested this could be one of the few sustainable ways to avert a funding crisis in response to Australia’s rapidly ageing population. Aged care spending is expected to more than double as a percentage of GDP in coming decades according to Treasury projections, placing significant strains on the economy and potentially dragging down standards of living.

Source: AMP Capital

“More property and infrastructure is going to need to be privatised by the government either re-tendering it or offering it themselves in order to pay for aged care,” AMP Capital portfolio manager Jonathan Reyes said, arguing that the ‘young’ should pay for aged care in the lively, global debate.

He gave the example of Transurban’s Australian toll road concessions, which will produce approximately $14 billion in earnings before interest, tax, depreciation and amortisation when those concessions expire.

“That could be re-diverted to aged care rather than being free for the younger generation to drive on the toll roads that their parents and grandparents paid for. It’s going to cost them money.”

Source: AMP Capital

Where there’s precedent

The idea is not without precedent. The cost of constructing the Sydney Harbour Bridge was recovered in the 1980s but the NSW government maintained tolls to pay for constructing the Sydney Harbour Tunnel. The NSW government has also had an asset-recycling program in place since 2012, selling public assets and re-using the capital to build or reinvest in infrastructure and services.

For some in the audience, it wasn’t too outlandish to redirect those funds to pay for the aged care bill.

Infrastructure represents a significant capital raising opportunity for governments given they still own almost 90 per cent of assets with just 4.8 per cent owned by listed equity investors and 0.6 per cent by unlisted equity investors.

However, charges on public assets (or those re-entering the public domain) may not always be palatable and the reasons will need to be clearly explained.

While this kind of solution might seem farfetched, the audience heard that if large but sustainable changes aren’t made to fund Australia’s ageing population, the younger generation may eventually have to accept lower levels of public funding for schools, defence, transport, communication, housing, community amenities, as well as recreation and culture.

The tax question

Higher taxes are also a possibility as governments search for new ways to pay for aged care. For example, the average Australian inheritance is currently four times the global average at approximately $500,000. Australia is one of the few developed countries in the world to not have an inheritance tax.

“The young people should basically consider that paying for aged care is just a down payment on that inheritance that they'll eventually receive.”“The young people should basically consider that paying for aged care is just a down payment on that inheritance that they'll eventually receive,” said AMP Capital portfolio manager Carlos Castillo, in making the case that the ‘young’ should pay for aged care in the debate.

A feel-good story

For those not inspired by either privatisations or tax hikes, the debate also raised other, creative and non-monetary solutions to help fund aged care. For example, young students in the Netherlands have the option of living rent-free in care homes where they keep elderly residents company for 30 hours a month.

“It helps with student housing affordability and aged care for the elderly although developed populations are ageing so rapidly it may not be enough,” Reyes said.

He added that while the example is a feel-good story, “it's probably not big enough to move the needle,” on what is a global and systemic issue on the horizon.

For more ideas, arguments, solutions and laughs from the Global Equities Forum watch the highlights of the debate in the video above.

The forum is a twice-yearly event where AMP Capital’s equities teams debate the issues impacting their investment decisions in a humorous format designed to promote blue-sky ideas.

Source: AMP Capital 7 April 2017